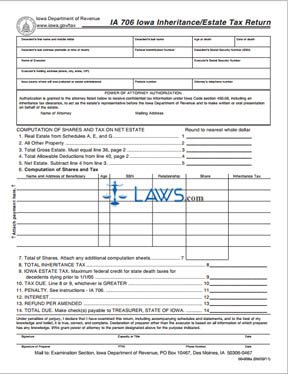

iowa inheritance tax form

SF 619 would phase out. Irrevocable trust beneficiary taxes differ significantly from state to state.

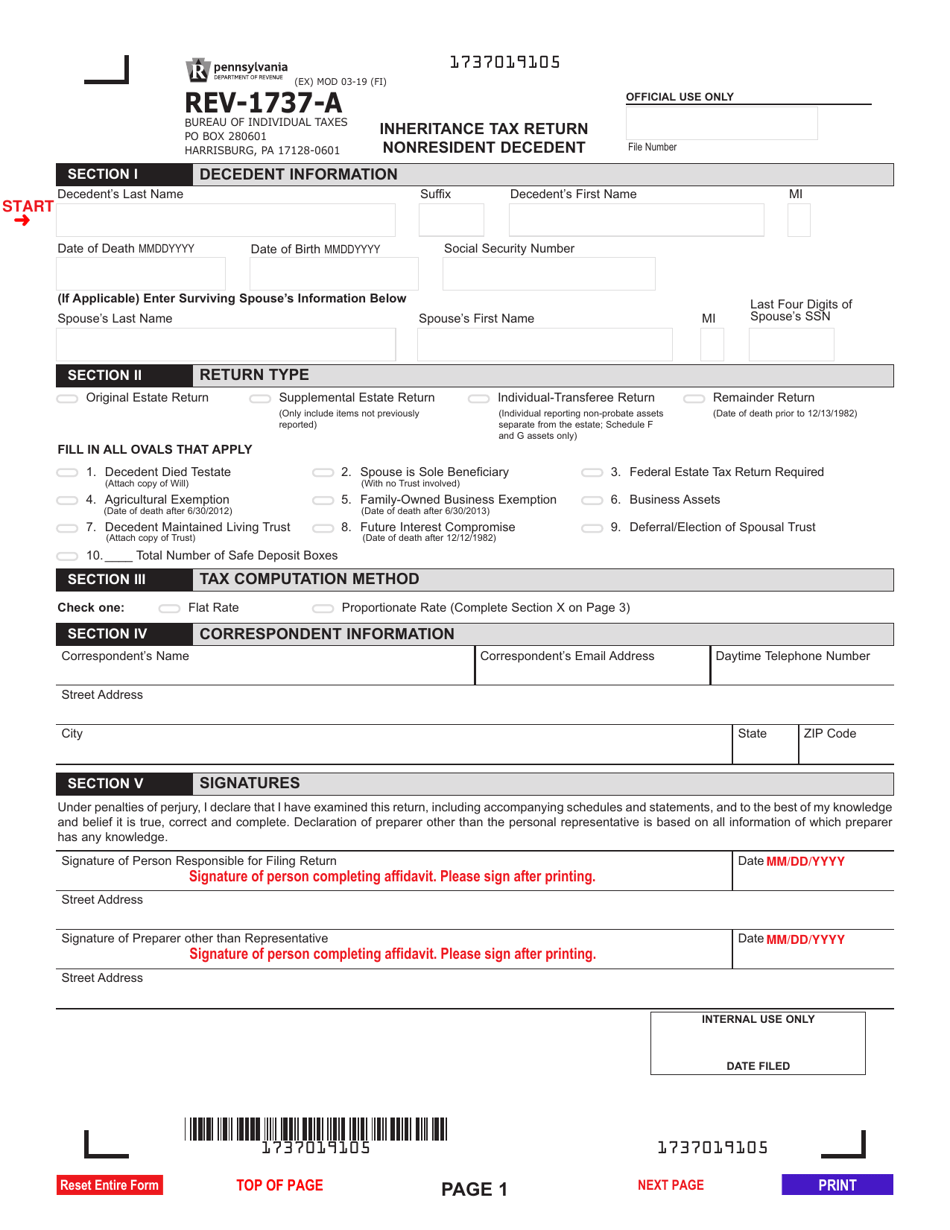

Form Rev 1737 A Download Fillable Pdf Or Fill Online Inheritance Tax Return Nonresident Decedent Pennsylvania Templateroller

Filing Frequencies and Due Dates.

. If you are a lineal heir such as a child or grandchild you may not have to pay an inheritance tax. Under current law an inheritance received by a lineal ascendant or descendant is exempt from the Iowa inheritance tax regardless of the value of the estate or the amount inherited. Tax season officially begins the same day as Federal return processing January 24 2022 and tax Iowa tax returns are due May 2.

Iowa inheritance taxes. Several states also impose an inheritance tax although whether or not you must pay such a tax depends on your relationship to the decedent. Iowa law allowed townships to levy a tax for fire protection and Columbia and East Des Moines Townships contracted with the City to provide this service.

Since 2018 Iowa has been working to lower income tax rates to provide tax relief and create a more competitive economy. Inheritance taxes in Iowa. For full details refer to NJAC.

Tax rates from 5 to 15 may apply to inheritances that are not exempt. Filing Made Easy provides a quick look at the process of filing an Iowa income tax return including Common Mistakes to avoid. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Pennsylvania has a flat state income tax of 307 which is administered by the Pennsylvania Department of RevenueTaxFormFinder provides printable PDF copies of 175 current Pennsylvania income tax forms. Immediate family spouses parents children are exempt.

Charities exempt up to 500The tax rate on others ranges from 5 to 15 of. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. If youre expecting to leave money to people when you die consider giving annual gifts to your beneficiaries while youre still living.

Circa 1960 the townships bought a fire truck on an International chassis with a front mount pump and the chemical tank truck was retired but the. Waivers Form 0-1 can only be issued by the. In addition to helping those in need you could potentially offset the taxable gains on your inheritance with the tax deduction you receive for donating to a charitable organization.

Iowa is one of a handful of states that imposes an inheritance tax. If you are not a lineal heir such as a niece or nephew or are not. Individual property owners from other townships could contract for fire protection.

1826-111 - 1125 Waivers Consent to Transfer How to Obtain a Waiver. You can give a certain amount to each person15000 for.

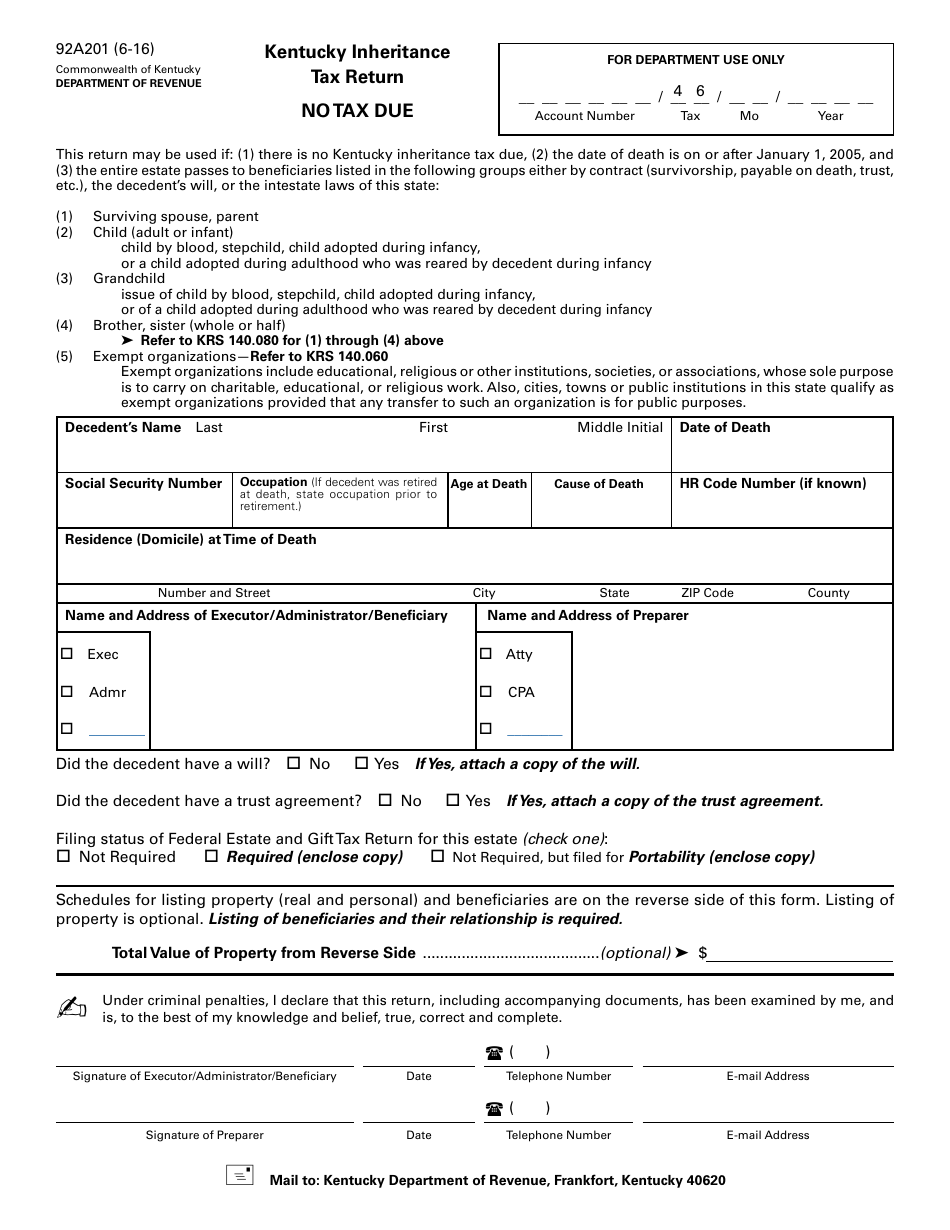

Form 92a201 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return No Tax Due Kentucky Templateroller

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

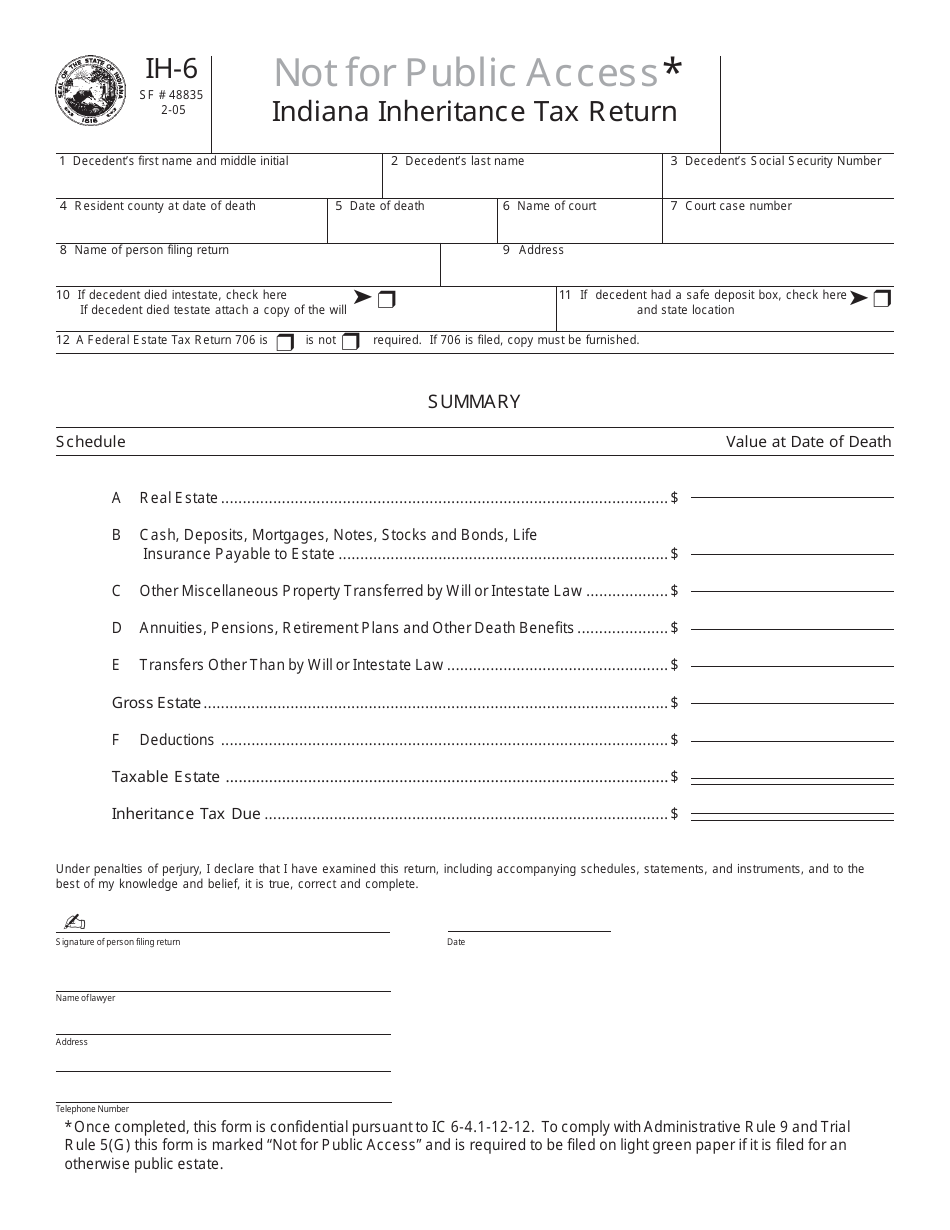

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Ky Inheritance Tax Forms Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)